LISTEN TO STEF GRAY:

Audio clip: Adobe Flash Player (version 9 or above) is required to play this audio clip. Download the latest version here. You also need to have JavaScript enabled in your browser.

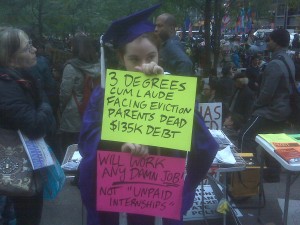

“I’d like to tell my 99 percenter story,” 23-year-old Stef Gray said yesterday at Occupy Wall Street in Zuccotti Park, now renamed Liberty Plaza. One of the two signs Gray held as she spoke read, “3 degrees cum laude. Facing eviction. Parents dead. $135K debt.” The other said, “Will work any damn job. Not ‘unpaid internships.'”

“I grew up poor and orphaned,” Gray said. “My dad passed when I was six. My mother passed when I was twelve. I spent my teens bouncing between homes of different family members where I was not necessarily wanted. I was told to stay in school and work hard… [so] I started college when I was sixteen [and] I got great grades.”

“I’ve worked two jobs to make ends meet pretty much the entire time while I’ve been in school,” said Gray, who’s in jeopardy of defaulting on her student loans. “Starting in January, I owe $700 a month on my $130,000 of student loan debt. That’s at 9.75 percent interest. The total amount just keeps snowballing higher and higher as I keep looking for jobs desperately. Right now, I can’t even pay my rent and I live in fear of homelessness and eviction.”

She’s not alone. USA Today recently reported that student loan debt in the U.S. is already greater than credit card debt and will soon surpass the $1 trillion mark. On top of that, the protections normally afforded debtors don’t apply to student loans, as Salon’s Alex Pareene noted:

“Thanks to the horrific 2005 bankruptcy bill, one of the most venal modern examples of Congress serving the interests of the rentiers and creditors over the vast majority, debtors cannot discharge student loans through bankruptcy.”

In addition to getting their pound of flesh irrespective of personal bankruptcies, the all-powerful creditors don’t offer students the chance renegotiate their loans if they’re experiencing under- or unemployment. “Half of my student loan debt is private through Sallie Mae [and] there’s no income-based repayment,” said Gray. “Even if I’m taking home $900 a month they can still demand the full $700. There’s no deferment for unemployment. There’s no interest rate caps… I just want to pay off my debt, but I don’t even have a fair chance.”

Related Links:

OccupyWallSt.org

StudentLoanJustice.org

Facebook.com/OccupyStudentDebt

Relatd Stories:

Occupy Wall Street: A Movement is Born, Sept. 30, 2011